At Sourcepoint, a Firstsource company, we’re leading this transformation with our UNBPO™ mindset, combining AI, analytics, and deep domain expertise to drive mortgage operations at the speed of now. Through connected, outcome-driven workflows, we help lenders and servicers execute faster, operate smarter, and stay ahead in every market cycle.

Why Mortgage 4.0 Matters

Mortgage leaders face growing pressure for faster decision-making, tighter compliance, and a stronger borrower experience. Borrowers expect quick loan processing. Investors demand accuracy and control. Legacy workflows are struggling to meet both. With UNBPO™, we help lenders and servicers operate with precision and scale, delivering measurable business results. Proven outcomes include:

50–70%

faster cycle times97%

fewer reworks40%

lower cost per loan95%

compliance accuracyAccelerate Every Stage of the Mortgage Lifecycle

Each solution is built to deliver agility, control, and performance in real time.

Automate verifications, credit decisions, and document processing for higher throughput.

Predict borrower needs and enhance retention with proactive, intelligent workflows.

Recover more with self-driving collections, digital outreach, and AI-guided decisioning.

What You’ll Gain

- A clear understanding of where process inefficiencies are impacting margins and customer experience.

- Targeted recommendations that balance capacity, volume, and quality.

- An actionable plan to implement next-generation mortgage operations.

What You'll Leave With:

- Clear understanding of where your process is costing you deals

- Specific recommendations tailored to your business model

- Action plan for implementing next-generation mortgage operations

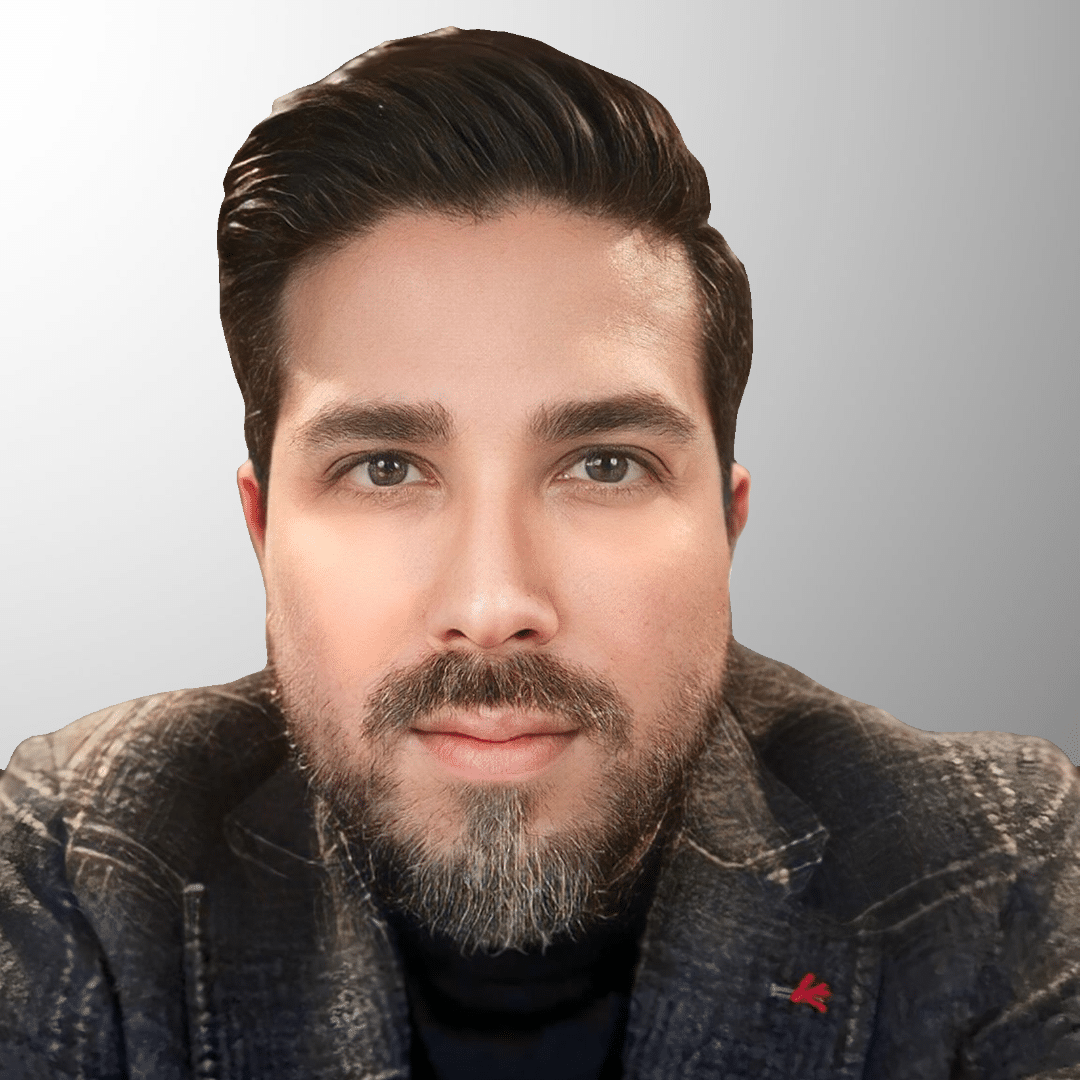

Meet Our Mortgage Leadership Team

Vivek Sharma

President, BFS

John Sarris

SVP – Head of Sales

Sreenath Shekharipuram

SVP – BFS Capability

Srinivas Vijayaraghavan

SVP – FS, AM, and Advisory

Sandeep Sudarshan

VP, BFS Solutions

Manish Jain

VP – Head of AI & Emerging Tech Architect

Rajkumar Ramakrishnan

VP - Operations

Matthew Slonaker

VP – Client Strategy

Abhinay Prasad

VP- Strategic Accounts

Jeanette Fitzgerald

AVP – Strategic Accounts

Anthony Golden

AVP – Business Development

Matthew Lichtner

AVP – Business Development