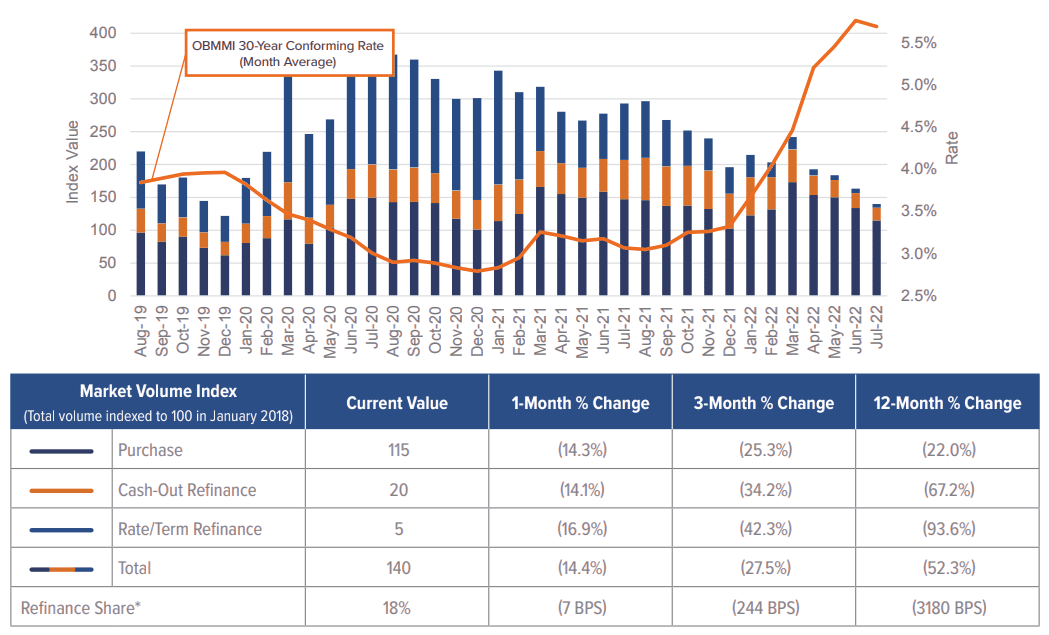

Mortgage originators continue to face strong headwinds. I recently accessed the latest Black Knight’s Originations Market Monitor report, as per which, rate lock activity has been down four straight months, with declines across all loan purpose types.

It’s noteworthy that purchase mortgages, which presently account for 82% of all lock activity, fell 14.3% by volume from June to July and 22% since last year. The purchase lock count, which doesn’t include the impact of soaring home values on volume, is off 25.8% from last year. It also makes July the first month — the number of purchase locks have fallen below pre-pandemic levels, as affordability challenges continue to cool the housing market.

Source: Black Knight

The month’s pipeline data showed overall rate locks down 14.4% MoM, led by a 16.9% decline in rate/term refinance locks — now down 93.6% since last year. Cash-out refinance activity fell another 14.1% from June — a 67.2% YoY decline. Moreover, the refi share of the market held at just 18%, the lowest point since January 2018.

As the refi frenzy dies down, mortgage originators are shifting to a purchase market, along with expanded Non-QM offerings — ensuring a higher risk stance. Servicing portfolios will witness an increased duration, and inflation and receding moratorium protections are going to result in higher delinquency and default. While you can’t control changing economic conditions or rising interest rates, you can manage your Quality Control (QC) processes efficiently.

Overcoming QC challenges has always been critical for mortgage servicers, but it’s especially crucial now. After all, regulators have promised to keep a close watch on servicers. Government Sponsored Enterprises (GSEs) and state regulators are turning their attention to ensuring lenders’ houses are in order. State reviews have escalated recently and lenders could find themselves in the compliance crosshairs if they don’t plan now for their Fannie Mae Mortgage Origination Risk Assessment (MORA) and Servicer Total Achievement Rewards (STAR) reviews.

Now more than ever lenders need a QC program with robust internal audit procedures to evaluate and monitor the overall quality of loan production. But mortgage organizations with independent internal audit functions often face challenges, including:

Inadequately staffed with limited number of auditors

Inexperienced staff lacking specialization in purchase and Non-QM loan programs

Inefficient audit protocols and response programs

Lack of expertise in liaising with FNMA teams

Moreover, with lower origination volumes driving an increased cost per loan, lenders need opportunities to cut costs while managing risks and quality control. With both monetary and labor resources at a premium, this is a tall task for enterprises to achieve and here is where an experienced QC partner can help. Outsourcing the QC function to an experienced third party can help ease the financial and personnel burdens of meeting these kinds of changes.

What to look for in your QC partner

Now that you know why finding the right QC partner is so important, you need to know how to find them. Here are 4 tips to help you:

1

Firstly, you should look for a partner who has the knowledge and expertise to deliver compliant audits and reports, allowing you to focus on customers and new loan origination. They will allow your company to focus on growth and borrower satisfaction, knowing that your Quality Control program will reduce your risk and satisfy the current and future expectations of investors and regulators.2

Evaluate the outsourcer’s capacity and access to global resources to deliver high quality loan reviews at a competitive price. Trusted services and audit credibility — Fannie Mae and Freddie Mac value outsourced audit management as unbiased, detailed and fully transparent.3

Ensure the provider is well established in the industry and has a good reputation among your peers. They should also have an impressive list of services from writing QC plans, evaluating policies and processes, performing QC, and assisting with intelligent sampling.4

The best partners put the icing on the cake with a high level of technology enablement in their service offering to drive efficiencies and robust reporting capabilities that allow you to view and sort findings seamlessly.Pro Tip: Do they have relationships with FNMA where they regularly share ideas on how to improve QC processes and issues?

If you look for a mortgage QC partner that checks all of these boxes, you can ensure compliance and avoid fines – even as regulators continue to closely monitor servicers.

Finally, it’s experience that will win the day — which is exactly why Sourcepoint recently acquired The StoneHill Group, one of the most respected QC providers in the industry today. Over the years, the knowledge, expertise and technologies that we’re using help mortgage organizations overcome today’s market challenges.

The risks may be larger than ever, but you can be more than ready to take them on.