Today, mortgage companies are staring down a perfect storm that will impact their ability to hold onto their market share. Demand for new mortgages is about to surge. Impending drops in interest rates are going to fuel demand in a way that lenders and servicers are currently not prepared to handle. In January, we sat down with a CEO of a top originator who was anticipating a market turn but felt we had at least 12 months to gear up.

A few weeks, interest rates slightly dipped and this same lender was already feeling the pressure of the emerging market to come. . Their workforce was overextended, burning the candle at both ends just to keep up with a small uptick in demand.

Mortgage companies just like the one I spoke with are watching the storm gathering on the horizon and hoping to ride it out. These market shifts happen all the time— interest rates, home sales, and mortgage demand rise and then fall, and this cycle continues. But we’re reading the market, and the message is clear: this shift will not be like any you’ve seen before. Take a look at why this time around is different.

The Current Mortgage Landscape

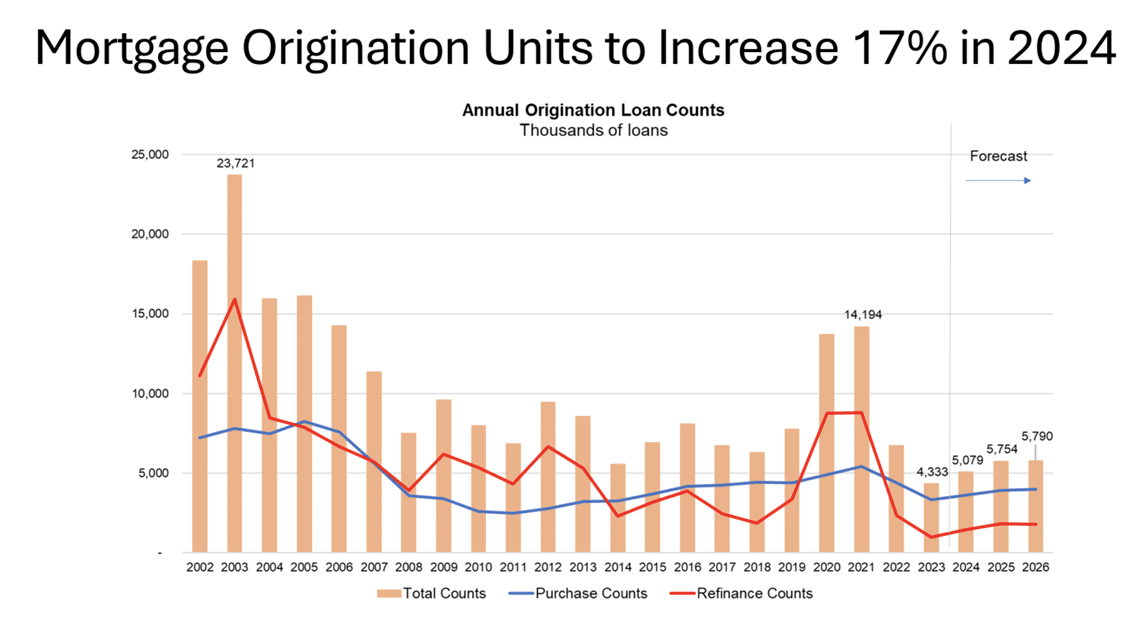

After record low mortgage rates and supersonic demand as a result of the pandemic, mortgage rates have increased steadily these past two years.

- The economic landscape has found its footing recently, yet it experienced significant fluctuations starting from 2020 up until mid-2023.

- The onset of the pandemic led to a drastic reduction in the federal funds rate, down to nil, which in turn sparked a surge in the housing market, sending property prices soaring. Subsequently, as inflation started to spiral, the Federal Reserve responded with a series of 11 rate increases.

- Meanwhile, the average 30-year fixed mortgage interest rate went from 2.8% in late 2021 up to a 22-year high of 7.79% in October 2023.

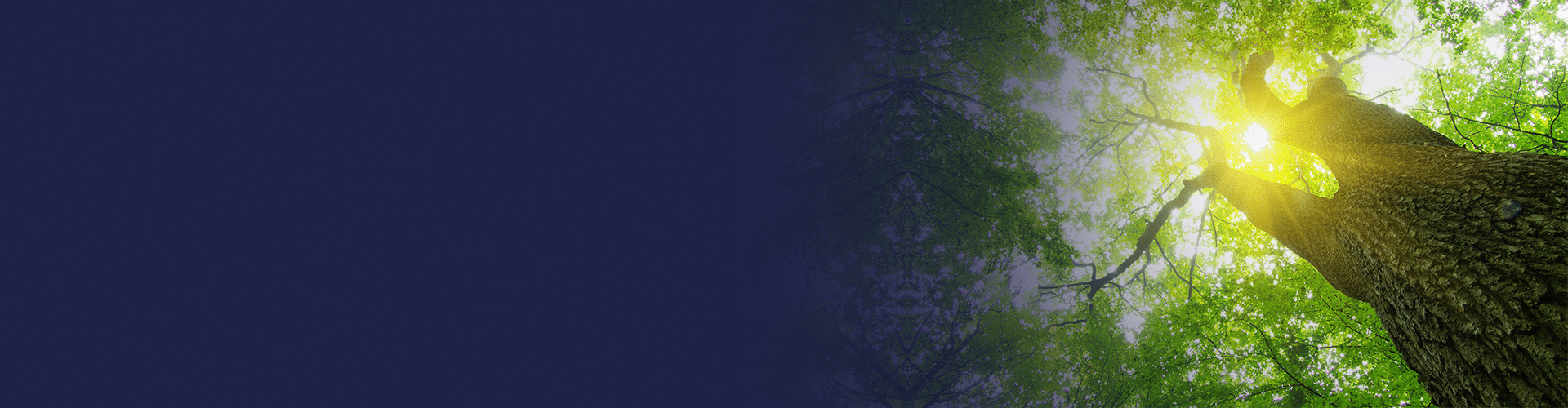

- As a result, Mortgage originations were cut in half from 2021 to 2022 and continued falling in 2023.

- From December onwards, there’s been a noticeable steadiness in mortgage rates, with a gentle sway between 6.5% and 7%.

- High mortgage rates, steep property prices, and a historic shortage of available homes are persistent challenges. Yet whispers of potential Federal Reserve reductions have many pondering their impact on this equilibrium.

Economists are anticipating multiple rate cuts from the Federal Reserve. These cuts will broadly impact the loan origination and servicing market. Mortgage origination volume is expected to increase 23 percent in 2024 to $2 trillion, with a 16 percent increase in purchase and a 50 percent increase in refinance volume,” according to the MBA's Economic Commentary Archives | MBA.

In addition, the MBA noted: “We are forecasting a 7 percent increase in existing home sales and a 14 percent increase in new home sales in 2024. Coupled with ongoing, but slower, growth in home prices, this sales growth 2 will support higher purchase volume.” Rather than a sudden spike, the current outlook is that mortgage volume, as well as refinance volume, will progressively climb throughout the year.

An Outsized Impact

Even though the rise and fall of the mortgage market happens all the time, this surge in demand is going to impact lenders and servicers disproportionately. It’s not just interest rates and rising demand that should be top of mind; it’s also how the world has completely turned upside down. And the rate and scale at which change happens has never been more pronounced.

We’re calling it now: the lenders who are prepared to navigate the shifting landscape are the ones who will corner the market.

The last time the lenders saw a demand surge, it was fueled by the lowest interest rates in history. Those rates drove refinance volume through the roof overnight, taking everyone by surprise. It was the fastest climb in demand in the shortest period the industry had ever experienced. No one saw it coming and no one was prepared to capture it. This time around, it’s different.

The reality of the locked-up housing market – with low home inventory, record-high mortgage interest rates, the lowest number of home sales in almost 30 years, and extremely low mortgage and refinance volume – led many companies to take drastic action. The downturn was in effect for such a long time – with little hope of letting up – that many organizations have cut staffing to the bone. Mortgage professionals that have remained are on the brink of burnout.

Facing down the talent shortage

When mortgage volume does begin to rise, talent issues will become clear very quickly. Alongside the overall increase in volume, there will be a need for speed. Since interest rates have been so high for so long, the incoming market shift will cause a snowball effect. First-time homebuyers have been priced out of the market for such an extended period of time that they are desperate to lock in a home. Even minimal changes in interest rates are impacting home buying activity. At the same time there are not enough homes for buyers entering the market. So, when an eager homebuyer finally finds a home, they need a loan fast. If the process slows down at any point, customer satisfaction will be impacted and companies risk losing business to competitors.

Maintaining exceptional service levels will be crucial during this period.

In today’s competitive landscape, lenders who prioritize a frictionless client journey, characterized by swift underwriting decisions and efficient closings, will stand out. The caliber of service provided will become the key competitive edge, as borrowers gravitate towards lenders who guarantee a dependable and streamlined experience.

However, firms that have calibrated their staffing to the current market demands may soon face operational bottlenecks. Given that an individual’s daily output has its limits, lenders will need to scale their workforce to uphold superior service standards. While this strategy seems straightforward, it’s complicated by several factors. The prolonged industry slump has led to a significant exodus of skilled professionals. As the market rebounds, the race to recruit talent to handle the influx of loan applications will intensify. With a finite pool of qualified candidates, securing top-tier talent will become increasingly challenging and costly.

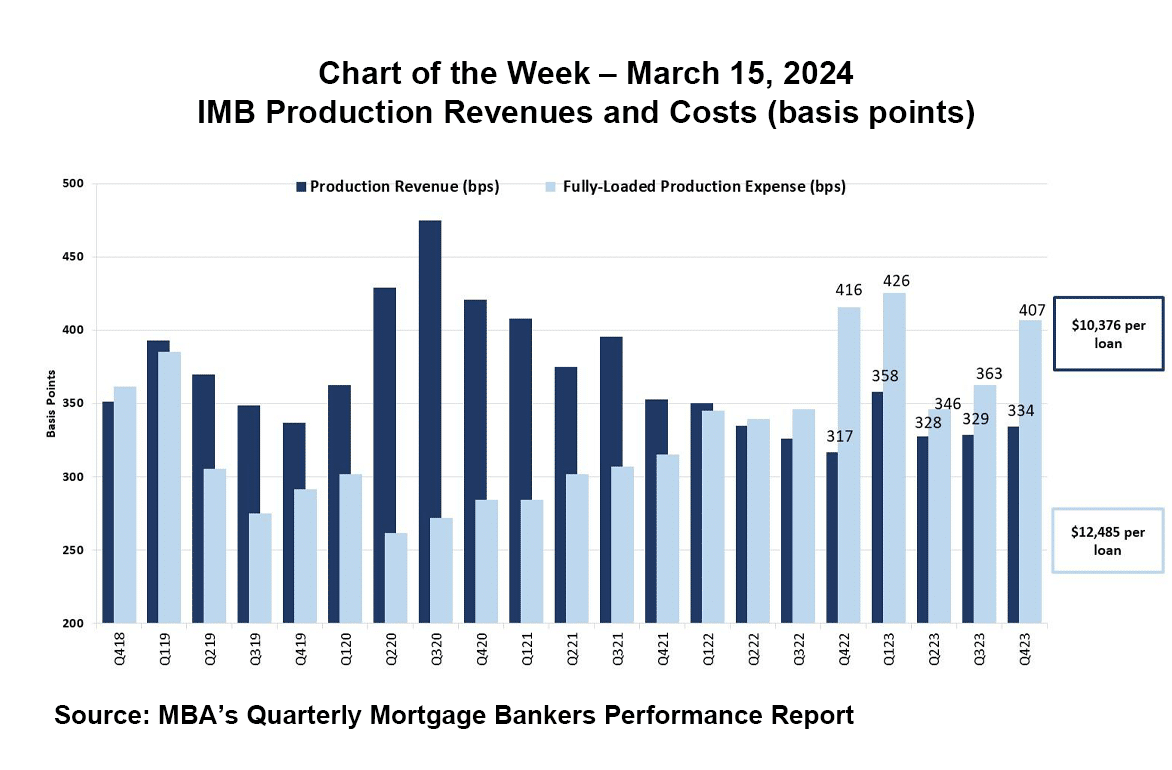

Origination Costs

Another indicator of the rigidity of major mortgage players comes when we examine the recent increases in the cost of loan origination. MBA data indicates that between 2008 and 2023, loan production expenses averaged $7,236 per loan. Production costs in the fourth quarter of 2023 averaged $12,485 per loan, an increase of over $1,000 per loan from the third quarter. With costs higher than revenue for mortgage originators, according to the MBA, the end of 2023 was the seventh consecutive quarter of net production losses.

The MBA reports: “The increase in production cost, along with a concurrent decrease in productivity, reflects excess capacity and the difficulty that lenders face in adjusting resources to align with fluctuating rates and volumes.” What does this mean? Over the past two years, major companies have been unable to keep pace with the market downturn, despite attempts to drastically slash costs and resources. We can safely say that over a few months, companies will similarly struggle to adjust to the market upturn, meaning origination costs will continue to increase while service levels suffer.

On the servicing side, lenders are closely monitoring the potential for increased MSR runoffs as rates decline. Borrowers who secured a loan in the last few years while interest rates were peaking will be eager for financial relief and will rush to take advantage of stabilizing rates by refinancing. Beyond the manpower to handle refinancing volume, high loan origination costs, along with a potential surge in prepayments, make the refinancing spike expensive for loan servicers. The risk of runoffs will be top of mind for many servicing leaders.

Don’t Just Prepare. Build a New Operating Model.

There has been another significant shift in the mortgage landscape since the last major spike in mortgage and refinance demand – artificial intelligence. The advancements in generative AI, automation, and other digital services are changing the way that work is done across all industries. The mortgage industry is no exception: AI has broad applications across the mortgage lifecycle, and the lenders that embrace these advances to build scalable, technology-enabled operating models are going to quickly become standouts in the field. Those companies will be able to lower the cost of loan origination and become more efficient.

In a recent conversation with a leading lender, I learned they’re intentionally overstaffed, maintaining surplus capacity to be primed for an upswing in the market. This approach, while cautious, is costly and rooted in an outdated operational framework that doesn’t align with the modern dynamics of the mortgage industry. Similarly, the rush to recruit more staff as demand increases is a traditional tactic that may not be effective in a transformed market landscape.

The solution for the future isn’t simply to hire more personnel; it’s about enhancing the productivity of the workforce you already have.

As we anticipate a surge in demand, the disparity between those who are prepared and those who are not—specifically, between those who utilize technology to boost their workforce’s capabilities and those who don’t—will become increasingly pronounced. Some organizations will elevate their service levels and capitalize on this moment. In contrast, others will find themselves scrambling to recruit, struggling to adopt new technologies, and striving to maintain cohesion—a model that’s far from viable in the long term. With the market gradually warming up and poised for growth, adopting a forward-thinking strategy now is crucial to keep pace with the evolving rate of change.

In our estimate, less than 8% of lenders are equipped with the technological and operational capabilities to manage the upcoming mortgage surge. This means that those who are prepared will have the opportunity to capture more market share. If you’re looking for more trends on operational readiness, email me at John.Sarris@Firstsource.com. For more strategies, keep an eye out for my next blog, “Opportunity is Knocking: Shifting Strategy to Capture the Market.”