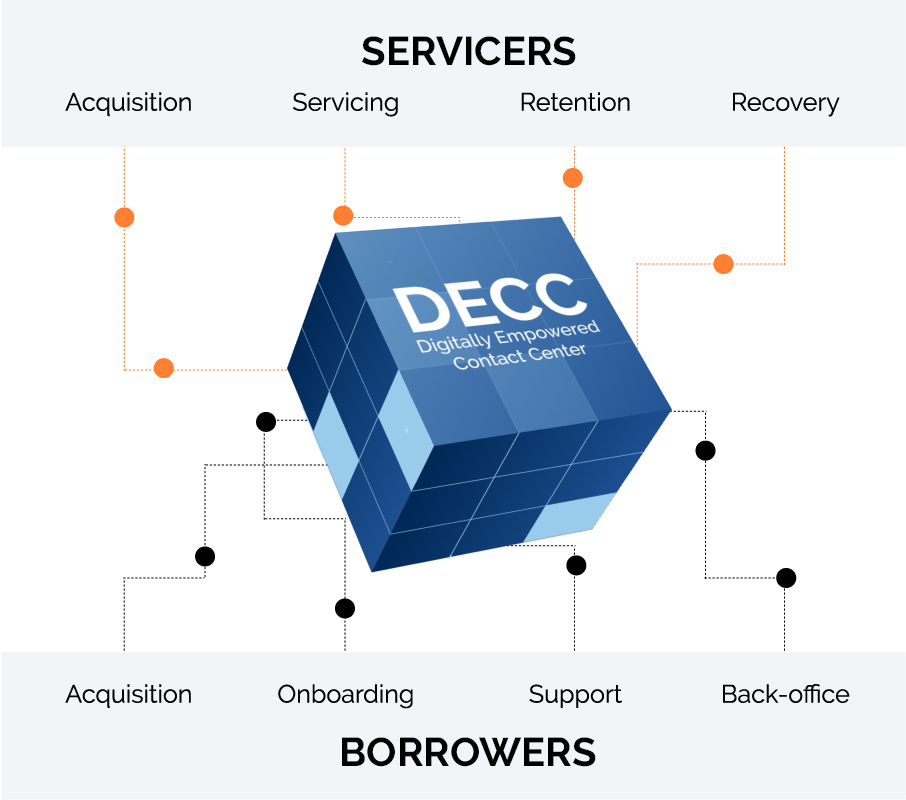

Digitally Empowered Contact Center

Digital-first contact center solutions for mortgage companies

Personalize consumer engagement across the mortgage lifecycle

Personalize consumer engagement across the mortgage lifecycle

Despite consumer expectations for digital services, the mortgage loan process is still highly paper based. Lenders and servicers must track documents across the lifecycle, identify and gather missing data, and ensure that all stakeholders receive the right information at the right time. Our Digitally Empowered Contact Center solution enables mortgage companies and consumers to benefit from a high-tech process that accelerates efficiencies as well as the human-touch, building transparency and trust. How do we do this? Our approach is based on four foundational pillars of customer experience: creating anywhere, anytime access to a flexible workforce; enabling channel freedom for borrowers; harmonizing humans and technology; and leveraging real time dashboards and insights.

Home buying is one of the biggest decisions people make in their lifetime. Unsurprisingly, today’s home buyers crave digital self-service across the mortgage loan process in combination with a human touch. Our contact center solutions help you deliver frictionless support geared to individual financial needs, meeting customers where they are. It digitizes processes and paperwork for enhanced agility and efficiency, and supplements it with empathetic human interaction across the mortgage lifecycle.

Intelligent Everything

People & Technology

Deliver delightful experiences across the mortgage lifecycle by proactively identifying needs and resolving issues. Our proprietary customer analytics solution firstCustomer Intelligence (FCI) provides rich insights into customer preferences and behaviors for superior retention.

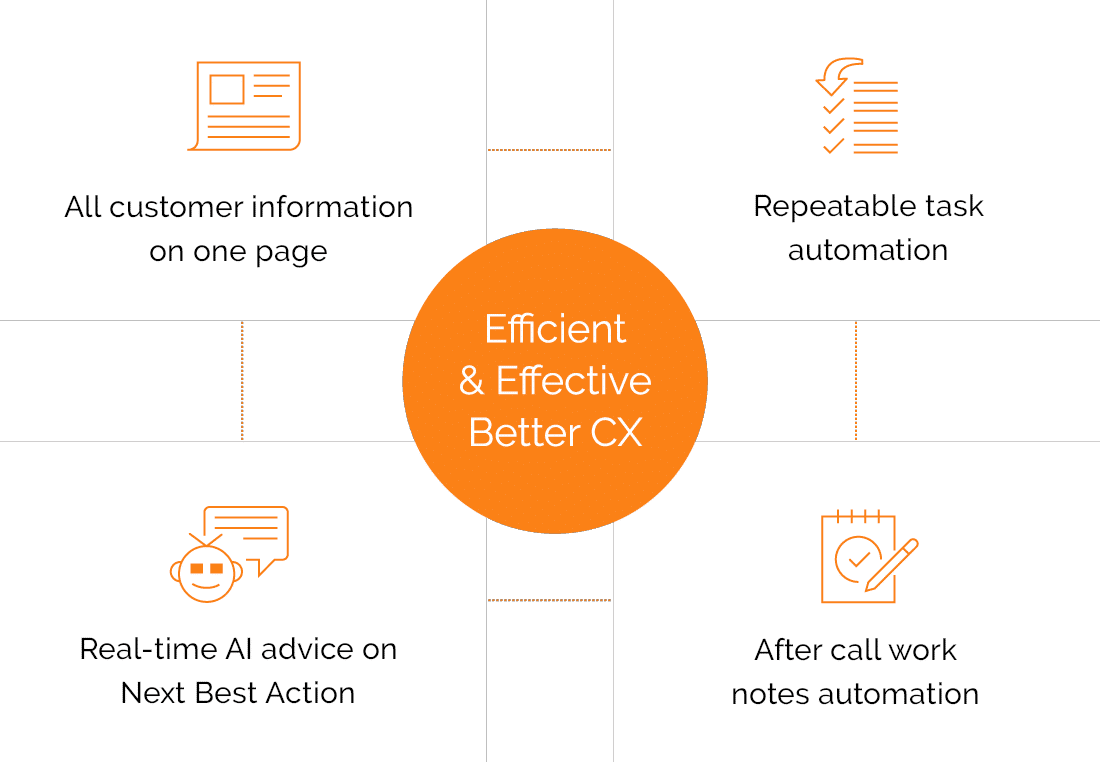

When bots pick up mundane, repetitive tasks such as fetching borrower information from multiple systems, human conversations become more efficient and meaningful. A whopping third of all borrower requests can be handled by chatbots, enabling you to offer 24/7 customer support and freeing up your associates to handle complex conversations.

DECC leverages CoBots, unattended digital employees that use Robotic Process Automation (RPA), to increase process efficiency across widely used mortgage applications. It also creates a Unified Omnichannel Desktop and displays Next Best Actions to inform associates, helping them tailor the mortgage experience and build long-term relationships.

Sourcepoint CoBots are pre-built automation solutions that are customizable and specifically designed to enhance the agility and efficiency of mortgage business processes. Most importantly, they can be securely integrated with your current technologies and platforms to maximize value. Let our army of CoBots automate mundane, repetitive tasks, saving you time and money and allowing your associates to focus on your customers.

HFS Point of View

Mortgage loan underwriting reviews made per year

Borrower contacts per year

US mortgage lenders serviced

NMLS #266274

Notice for NV Residents: (1) Collection Agency License Number CAD11879; (2) Compliance Manager Certificate Number CM12902/NMLS #1499266 Compliance Manager.

Sourcepoint Solutions in lieu of Sourcepoint, Inc. NMLS #266274

Simply fill out this form to download